Mutual Fund Is So Famous, But Why, and how to invest in mutual fund ?

Will see lots of ads on TV talking about mutual fund and its benefits. in this blog, we are going to see how much beneficial is this and what is the dark side of the mutual fund.

What is a mutual fund?

A mutual fund is a where you can save/invest your money to get some more percentage of interest rather than banks giving. your money is saved in the "Asset Management Company". In TV ads you hear many times that "It subject to market risk". To understand this you have to also know the below questionPros and Cons of Mutual Funds?

Pros:-

if you have not interested in doing things on your own in the stock market then this is a good choice to start

Cons:-

1. The expense ratio is defined as the annual fee that an investor is charged for the management of funds. This will eat your return in the long term, for example, we did a calculation with random mutual funds.

if you do the SIP 10,000/- Rs per month for the duration of 40 years with an average return of 15% then you get in total about 15 Crores. but after cutting off the expense ratio we get only about 11 crores back so from this example we can learn that the expense ratio will eat the return in the long term

2. if you redeem the money in less than one year then you will be charged the short term charges. If you decide to redeem a fund before you complete 1 year of the investment, you may be asked to pay an exit load of 1%

if you do the SIP 10,000/- Rs per month for the duration of 40 years with an average return of 15% then you get in total about 15 Crores. but after cutting off the expense ratio we get only about 11 crores back so from this example we can learn that the expense ratio will eat the return in the long term

2. if you redeem the money in less than one year then you will be charged the short term charges. If you decide to redeem a fund before you complete 1 year of the investment, you may be asked to pay an exit load of 1%

How the mutual fund works?

First, the mutual fund manager sets some rules about the mutual fund they are managing Then you invest your money in the mutual fund. Like they decide some amount so they can start investing in government securities, share market, and Government bonds. After that when the get some profit. They will give you that percentage. This means you are indirectly investing your money via some professionals. Via using these mutual funds. You can earn more interest than your bank is giving.

How to select your best mutual fund?

There are many categories of mutual funds that you can choose to invest but you can refer to this formula that I suggest. If you want to be on the safe side. Then you can use these formulas.If you want to invest more than 5 years you can invest in "Equity".

If you want to invest in about 3 to 5 years. Then "Debt" is a good option.And if you are not sure about how much time you are going to invest you can diversify your investment portfolio. What is means it means that you are investing in lots of categories of the market so the risk will get balanced. The above suggestions are my opinion. You can do what you like to do.

How can I start investing in mutual funds?

It's just a click away to start investing in mutual funds. you can start investing from the smartphone also. You just need to follow the following steps.Step 1

first, you have to download the following app.Step 2

when you completed your download then open the app and sign in using your Gmail id. then give the all details that the app asking for. when you completed all steps then you can see all mutual funds on the home screen.Step 3

now you successfully signed in so you can now start investing in the mutual fund, for that you need to select the mutual fund you decided if you were unable to find it so you can search it via using the search button and via typing the name of mutual fund you will find it easily.Step 4

so you selected the fund, but there are 2 options available "SIP" and "One-Time".SIP stands for Systematic Investment Plan, is just like the RD (recurring deposit). the fixed amount decided by you will be automatically deducted from your bank that you choose.

One-Time means if you plan to deposit a big amount then you can use this option.

Step 5

just like shopping on Amazon or Flipkart you need to buy the mutual fund and your now an investor.but if you stuck with the problem of "Mandate" then it's also easy to process

What is the Mandate?

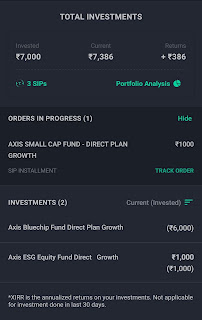

the mandate is the setting that you have to do when your applying for the "SIP", for the automatic deduction of payments from your account from every month. this is necessary.Just for inspiration here is my portfolio screenshot

Post a Comment